Everything Madoff: The Monster Of Wall Street Didn't Tell You About The True Story

Since the Bernie Madoff Ponzi scheme was uncovered in 2008, there have been numerous attempts at uncovering the complete story behind the headlines. Several documentaries, YouTube videos, and podcasts have discussed the topic, but Netflix seems to have released the definitive documentary about the scandal. "Madoff: The Monster of Wall Street" does an excellent job at explaining how the illegal operation worked, why so many people fell under the financial advisor's spell, and the consequences both the victims of the scam and the Madoff family suffered as a result. The story is told in such an intriguing and emotionally compelling manner that it leaves the audience wanting to know more about the case.

The documentary series manages to explore the most important aspects of the scandal. It tells the story of how Bernie Madoff became a man respected by the most important people and organizations on Wall Street, describes the way he treated his family and co-workers, and explains how close the authorities came to discovering his Ponzi scheme on multiple occasions. Having said that, there's only so much information that can be told in such a short number of episodes, leaving a lot of unanswered questions. Audiences probably want to know exactly what happened to Madoff's wife after she was evicted from her husband's seized properties, how the scandal affected various charities, sports teams, and celebrities, and the impact of Bernie Madoff's actions in popular media. Here's everything "Madoff: The Monster of Wall Street" doesn't tell you about the true story.

The only proven connection between Madoff and organized crime came after the scandal

One of the most intriguing arguments the documentary makes is the suggestion that Bernie Madoff received money from organized crime. Given that he was collecting money from people all over the world and that he was accepting these investments without asking many questions, some have suggested that he provided an ideal means to store ill-gained profits. This also led to theories implying that his act of accepting a plea deal was intended to seek protection from the mob. However, none of these theories have been supported by evidence.

Curiously, the only proven connection between Bernie Madoff and organized crime came after his arrest. Market Watch reported that Bernie Madoff became friends with the boss of the Colombo crime family, Carmine John Persico Jr., in prison. Supposedly, this relationship resulted in the mob protecting Madoff during his incarceration. Persico also provided him with gifts in the form of benefits like uninterrupted access to television and some guidance regarding how prison works. This might have allowed Madoff to develop friendships with different types of prisoners and even provide them with financial advice.

The scam almost ruined the Mets

The Wilpon family, who owned the Mets, gave millions to Bernie Madoff. They planned to hire valuable players and enter substantial sponsorship deals all financed by profits expected to come from their investments with Madoff. Of course, these profits never materialized, and the team had to come up with new ways to pay for these deals very quickly. That money came primarily from Wilpon family funds, as well as loans. In fact, at one point the team's only trustworthy source of income became the sale of tickets and food inside the stadium. As a result, spending on different team operations had to be drastically reduced. Their payroll budget, for example, decreased by approximately $64 million in five years, gravely affecting the Mets capacity to compete with other teams. Almost half of the team had to be sold to other investors, too.

As if things couldn't get any worse, the Madoff trustee fund, which was collecting money from the earlier investors who withdrew their money with profits, sued the Mets. The fund alleged that during their relationship with Madoff, the scammer had paid some of their investments back, which is how the Mets financed some deals. Eventually, a judge ruled that the amount owed was $386 million, and the trustee settled for $162 million (via The New York Times). Still, this didn't change the fact that the team had to keep functioning with a terribly limited budget, which impacted their performance and, naturally, fan attendance for years to come.

Hollywood celebrities lost and recovered millions

The tentacles of the Madoff organization extended across countries and industries — not even Hollywood was safe. Interview legend Larry King initially gave around $700,000 to Madoff, but according to CBS News, he was able to recover all his money. Actors Kevin Bacon and his wife, Kyra Sedgwick, apparently had a sizable portion of their money invested in Madoff, too. But as Bacon has explained, part of the money was recovered. He added that he wasn't very eager to discuss the matter because, as he put it in the "SmartLess" podcast (via Entrepreneur.com), a lot of people suffered more due to the scam, and he didn't want to take attention away from them.

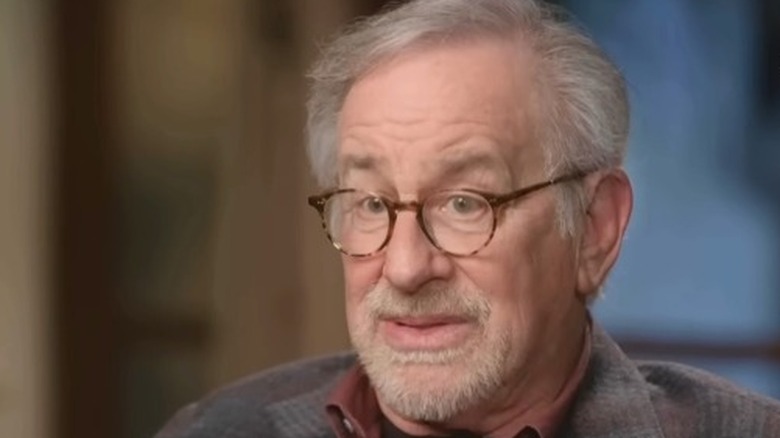

Probably the most powerful man in Hollywood who lost money due to Madoff's lies was Steven Spielberg, although the director didn't lose any of his personal money. According to the Jewish Journal, Spielberg's charity, The Wunderkinder Foundation, had approximately 70% of its money invested in the Ponzi scheme. It's not clear whether the charity, which uses its funds to support arts, education, and health, had to reduce its size and work due to the scam, or how much money it was able to get back. However, this wasn't the only charity Madoff took advantage of.

Madoff may have purposely targeted charities

One of the first things that caught people's attention in regard to Bernie Madoff's investors was the number of charities affected. As Reuters explained, organizations like the JEHT Foundation, which focused their efforts on the reform of the juvenile justice system, had to close because of the amount of money they put into the scheme. Others like Gift of Life Bone Marrow Foundation saw its income decrease considerably as its contributors were affected by the scandal. In addition, many Jewish charities suffered because of Madoff's use of his connections within the community to attract funds. But there may have been an additional reason for the number of charities that lost money to Madoff's scheme.

CNN Money has an interesting theory regarding how Madoff saw charities. These types of organizations may spend millions of dollars on management and, of course, helping people in need, but they are only required to spend a small fraction of the money they manage to collect. In fact, the law only requires charities to spend 5% of their funds per year. This means that charitable organizations usually aren't in sudden need of funds, nor are they inclined to frequently withdraw large amounts of money. This turned them into a relatively safe bet for Madoff; charities would pour millions of dollars in the scheme, but they wouldn't bother with demands of massive returns on a regular basis. As a result, the financial advisor was free to do with charity money as he saw fit, whether this meant buying a yacht or paying other older investors to maintain the appearance of a profitable business endeavor.

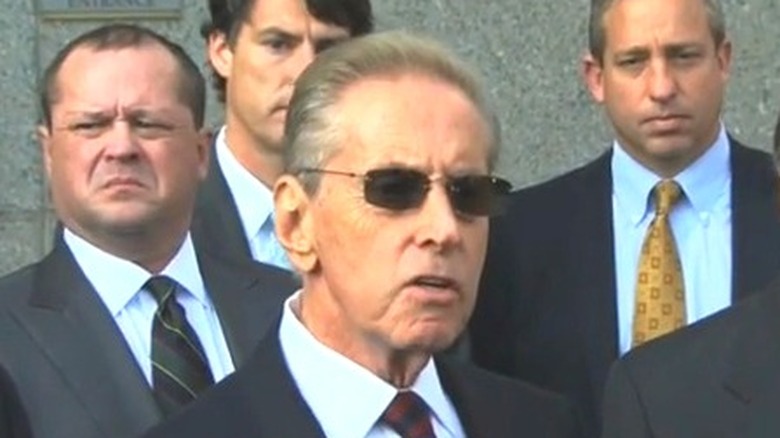

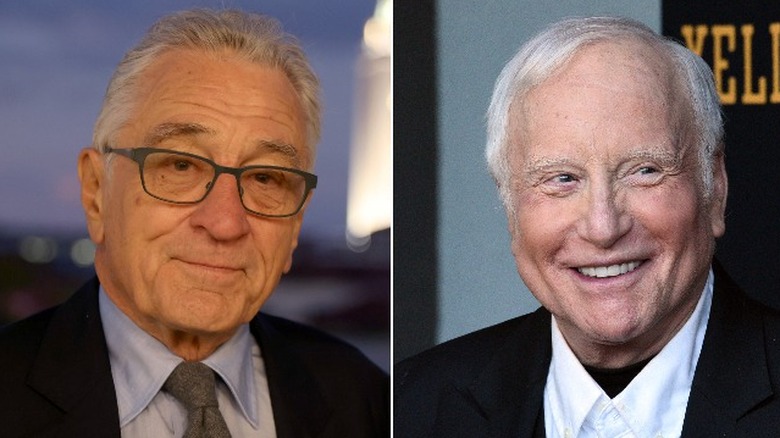

Bernie Madoff was played by Robert De Niro and Richard Dreyfuss

Hollywood is known for quickly seizing the rights to real-life events that capture the public's imagination in order to make a movie version. In the case of Bernie Madoff's scandal, it would take eight years for the first movie to be released. ABC's 2016 two-part movie "Madoff" sees Academy Award winner Richard Dreyfuss and Blythe Danner play Bernie Madoff and his wife Ruth. The production takes a more sinister approach to Madoff's personality, as the actor portrays him as an egocentric bully and occasionally shows a devilish smirk, turning the character almost into a comic book villain. Nevertheless, Dreyfuss was praised for his performance – Vanity Fair described it has his best work in years.

By contrast, in 2017, Barry Levinson — known for movies like "Wag the Dog" and "Rain Man" — directed a more realistic take on the infamous scammer. "The Wizard of Lies" is an adaptation of the novel of the same name by author Diana B. Henriques and focuses on the drama revolving around Madoff's family as they discover that their fortune is built on a house of cards. The roles of Bernie Madoff and Ruth fall on Robert De Niro and Michelle Pfeiffer, while Alessandro Nivola and Nathan Darrow play their sons. De Niro's Madoff is, this time, presented as an apparently reserved man who has mastered the art of enticing new investors, but who fails to predict the consequences of his actions, especially as it pertains to his family.

Bernie Madoff's wife Ruth wasn't left homeless

The documentary tells the sad end of the Madoff family. Bernie survived both his sons, one of whom died by suicide, the other from cancer. The last episode shows Bernie's wife Ruth being expelled from the expensive apartment she lived in and moving into a car. The truth is that while Ruth had to give up most of her money, she was still left with enough funds for a comfortable lifestyle, albeit a considerable downgrade from what the Ponzi scheme had allowed her at one point. She would also spend her time trying to stay out of the spotlight and denouncing his husband's scam with varying levels of success.

Ruth lived in Florida for a while, then she moved into her son's house in Greenwich, Connecticut, but she had to leave soon after his death from lymphoma. Then she moved into a gated community with different amenities in Greenwich. Interestingly, while Ruth doesn't welcome journalists and paparazzi, she did meet several times at her home with Michelle Pfeiffer, who was allowed to observe her in preparation for her role in "The Wizard of Lies." Despite her attempts at escaping her past, to this day people looking for interviews are constantly knocking on her door. On top of that, some neighbors and shop owners don't seem to be very happy with her presence, arguing that it is hard to believe she didn't have anything to do with what happened.

If you or anyone you know is having suicidal thoughts, please call the National Suicide Prevention Lifeline by dialing 988 or by calling 1-800-273-TALK (8255).

The scandal may have inspired the award-winning film Blue Jasmine

In 2013, Woody Allen directed a film about a rich woman who is suddenly forced to change her lifestyle. In "Blue Jasmine," the title character discovers that her husband, who she thought was a successful entrepreneur, is actually behind a massive Ponzi scheme. After he's arrested, Jasmine has to let go of her properties, luxury items, and income. Jasmine, played by Cate Blanchett, is also expelled from her usual social circles, while everyday individuals resent her for the alleged ties to the scam that affected thousands, something that eventually impacts her mental health. For this role, Blanchett received critical praise as well as her second Academy Award. But despite the similarities with Ruth Madoff's life, the team behind the film has been very reluctant to admit the connection to Bernie Madoff's scandal.

It's no secret that "Blue Jasmine" draws inspiration from other fictional works like Tennessee Williams' "A Streetcar Named Desire." However, when it comes to real-world influences, both the director and lead actress are not comfortable admitting certain connections. In an interview with The Guardian, Allen denied that he was inspired by the Bernie Madoff scandal. Cate Blanchett, on the other hand, confirms that she was aware of the scandal, but is very careful to avoid any credit to the idea that she is playing Ruth Madoff. Both Blanchett and Allen express that there are many women who have found themselves in that situation, and that type of story is what inspired the plot for the movie.

Not even FTX lost as much money as Bernie Madoff

The documentary ends by stating that the Madoff scandal was the biggest scam ever to take place in America. Having said that, the number of pyramid scams and Ponzi schemes seen after Madoff's arrest gave dishonest people plenty of opportunities to challenge that statement. Some of the biggest scams have taken place in the crypto space; BitConnect and Celsius were accused of being Ponzi schemes, while coins like Thodex and Anubis were allegedly part of a rug pull. But without a doubt, the biggest alleged scam was committed by FTX.

As explained in NBC News, FTX was a complex organization. On one hand, FTX was an exchange where people could buy and sell different coins. What made this exchange different is that it had its own cryptocurrency and paid higher interest than banks. The founder of FTX, Sam Bankman-Fried, also owned the cryptocurrency trading firm Alameda Research (via Tech Target). The company performed different financial activities like market making and arbitrage. That is, until a Coindesk article revealed that the company had a balance of negative $8 billion. Turns out Alameda Research lost a lot of money through risky investments and increasing debts. When this happened, FTX funds came to the rescue as if the companies were the same entity (via Time).

People have argued that FTX lost more money than Madoff, citing that the company was valued at $32 billion (via CNBC). However, this amount wasn't based on facts, but on expectations of the future of the company. In reality, FTX lost $8 billion, less than half of what people gave Madoff to invest.

Most of the money people invested was recovered, but the total amount may be gone forever

The documentary states that the amount of money people handed to Bernie Madoff was approximately $19 billion, while the profits he claimed their investors earned reached $69 billion. According to The Madoff Recovery Initiative, approximately $14.5 billion has been recovered. This money came, as the documentary explains, through the fake profits obtained by other clients who were forced to give back this money, among other sources.

Sadly, in order to obtain the money, the victims' trustee had to agree to various settlements, which means it's unlikely that the complete amount invested in Madoff's scheme will ever be recovered. In addition, the efforts from the victim's trustee are focused on the money they gave Bernie Madoff, not the false returns the Ponzi schemer promised the victims. So even if the victims' money was returned, the interest they could have received by simply leaving their money in a bank, or the potential returns that could have resulted from safer investments, is lost forever.

The biggest amount recovered from a single individual was $7.2 billion

The mini-series suggests that Jeffry Picower was one of the most important investors in the scheme, but that came at a price for Madoff. It's heavily implied that Picower put money in the scheme to help Madoff pay some investors, and that this came in exchange for enormous withdrawals from his investments and the promised profits. In other words, Picower was allowed to freely withdraw money and returns in exchange for rescuing the scheme when it needed it.

The New York Times estimated Jeffry Picower made roughly $7.2 billion. This amount was calculated by adding all the money Picower withdrew and subtracting the $620 million he initially gave Madoff. Picower died of a heart attack in 2009, so his widow was in charge of negotiating the settlement. In a surprise move, the widow agreed to pay all the money back. Mrs. Picower continues to insist that her husband didn't know what Madoff was doing, even though many people think that the amount of money he put in and withdrew from the scheme suggests otherwise.

The scandal had a ripple effect on public trust in financial advisors

The Bernie Madoff scandal had various effects on the financial sector. Many financial advisors and hedge funds trusted Madoff and gave him their clients' money. On top of that, regulatory entities like the SEC failed to act upon the multiple red flags. More importantly, Madoff himself was seen as one of the most trustworthy people in the business, and yet he ended up being the head of the biggest Ponzi scheme in history. Naturally, some people felt that they could no longer trust the financial sector as a whole, but the reputation of financial advisors took an especially brutal drubbing.

A study by the University of Texas at Dallas paints a clear picture of these effects. After locating the communities most affected by Bernie Madoff's Ponzi scheme, researchers found that people who lived in areas that were hit hard by the scam relied less on investment advisors, opting to take their money and put it in more reliable institutions like banks. In addition, financial advisors who worked in these areas were found to be more likely to close their businesses. All in all, even if regulatory bodies didn't change their practices too much after the scandal, many people decided they couldn't trust the financial system and opted to be more careful when deciding where to put their money.