The Most Expensive Deals On Shark Tank

This content was paid for by Sony and created by Looper.

Most TV shows are designed to entertain audiences and evoke some kind of emotional response — a laugh, a tear, or a gasp, perhaps. And ABC's "Shark Tank" does a little bit of everything. Not only does it make for engaging television, but it has also helped a lot of inventive people achieve their dreams. The reality series, which debuted on ABC in 2009, sees the owners of small and burgeoning businesses get the chance to meet some of America's most successful and active venture capitalists, including Mark Cuban, Kevin O'Leary, Robert Herjavec, Daymond John, Lori Greiner, and Barbara Corcoran. After explaining their business plan, entrepreneurs then ask for a sizable investment in exchange for a share in the company, and these sharks get to decide whether to jump into the tank and with how much of their cash.

Across the first decade of "Shark Tank," nearly 900 entrepreneurs had negotiated about 500 deals with the show's resident Sharks, for a total of more than $140 million in investments and company valuations worth more than $1 billion. On average, business people walk out of the tank with just under a quarter of a million dollars, but there are some who got a lot more because their ideas were just that exceptional. Here are some of the most notable — and wildly lucrative deals — ever made on "Shark Tank."

Circadian Optics' creator turned on the lights on Shark Tank

A TV show featuring entrepreneurs pitching their wares is a good idea, but "Shark Tank" is compelling because of the human interest element. Viewers may be deeply moved by the pitcher's origin story, or why they invented or developed the thing they're trying to bring to market.

In 2019, Amber Leong came to "Shark Tank" with a powerful story that brought the generally unflappable panelist Kevin O'Leary to tears. Long explained that she grew up in Malaysia without a lot of money, but that her parents gave her all the money they had (and borrowed more) to send her to college in the U.S. Months after her arrival, she fell ill and was given a 50 percent chance of survival. When she recovered, Leong knew she had to do something remarkable with her "one wild and precious life" and she chose "creativity over certainty" and started Circadian Optics, a home lighting company that uses special LED tech to mimic daylight. The firm's products purport to enhance mood and improve sleep and energy levels via the power of light therapy.

Leong's intention with "Shark Tank" was to offer a 10 percent stake in Circadian Optics in exchange for $750,000. "You represent everything great about entrepreneurship, the American Dream. You are freedom," investor Mark Cuban said before teaming up with Lori Greiner to give Leong that $750,000 (plus another $50,000 to go directly to her parents) for 20 percent of the business.

Bala Bangles got the results its fitness entrepreneurs wanted

Good or creative presentational skills on the part of the entrepreneurs don't necessarily lead to a big "Shark Tank" deal, but putting on a little show will certainly get the show's resident investors listening. In a 2020 episode, Natalie Holloway and Max Kislevitz came into the Tank bursting with energy, reminiscing about how back in the 1980s, "aerobics were all the rage" and that it spawned a lot of "wacky fashion." Cue the small army of time-traveling aerobics enthusiasts, dressed head to toe in headbands, leotards, leg warmers, and wrist and ankle weights — the latter two of which Kizlevitz pointed out are the only parts of those ensembles that haven't changed much in 40 years.

His and Holloway's company, Bala Bangles, offered a new take on exercise-enhancing weights one can wear on their arms and legs that are both stylish and simple and which allow users to "sweat in style." The Bala team's initial pitch: a 10 percent stake in the company in exchange for a $400,000 investment. Kislevitz and Holloway walked away with a lot more, but also gave up a lot more. Regular "Shark Tank" investor and guest panelist and former professional tennis player Maria Sharapova combined their efforts into a $900,000 investment for a 30 percent stake.

Was this Shark Tank deal for a wheel for real or a steal?

Recurrent, nagging back pain is just a part of life for people who get to a certain, middle-to-advanced age, or for those who engage in repetitive physical tasks on a daily basis. Apart from inexact remedies like medication or chiropractic medicine, sufferers may purchase a foam roller, a firm device that rolls along the spine, putting relieving pressure on an aching back.

But as it turns out, those rollers aren't so great either — at least according to entrepreneur and Chirp Wheel creator Tate Stock. On a 2020 episode of "Shark Tank," he demonstrated his take on the foam roller. Its innovation is in its simplicity: Other foam rollers are often more than a foot wide, while the Chirp Wheel is a compact five inches. That allows the user to target exactly the painful spots they wish to soothe.

Stock wanted a whole lot of money for a very small portion of his company: $900,000 for 2 percent. Investor Lori Greiner got him to come up somewhat — she'd give him his $900,000, but for a 2.5 percent stake, and he'd have to repay that near-million bucks in two installments within a year and a half.

Bee D'Vine landed a honey of a deal on Shark Tank

Alcohol companies often do well on "Shark Tank" because adult beverages sell extremely well and often at a high mark-up, which generates more profits for stakeholders. Take Bee D'Vine, for example, a product pitched by entrepreneur Ayele Solomon on a 2020 episode of "Shark Tank." He started Bee D'Vine, a company that makes wine out of sustainably produced honey. (Technically, that's more than wine, it's mead, an ancient alcoholic beverage made from bees' sweet gift to the world.)

Solomon admitted to the Sharks that a bottle of his wine cost $5.93 to produce, but which he sold for a retail price of $39.95. While that's a big and attractive margin on paper, investor Kevin O'Leary thought it was too high of a price point, pointing out that 97 percent of the wine market is from sales of product that costs $14 or less.

Nevertheless, the product was good enough that every investor in the room besides O'Leary had some interest. In an almost unheard of arrangement, nearly all present Sharks went in on an offer together. In a counter to Solomon's ask for $750,000 for a 20 percent stake in Bee D'Vine, investors Mark Cuban, Robert Herjavec, Lori Greiner, and guest panelist, Kind Bars founder Daniel Lubetzky put up that three-quarters of $1 million for a shared 40 percent stake.

BeatBox Beverages rocked a tasty investment

Very often, marketing alcohol is about selling the idea of a fun, cool, memorable hang — the notion that the drink being advertised is so cool and easy that it will fuel the perfect party. That's what the makers of BeatBox Beverages were going for when they appeared on "Shark Tank" in 2014.

"You don't sell wine, you sell fun," "Shark Tank" panel investor Mark Cuban said during the episode. Comparing itself to Red Bull but resembling an adult-oriented Capri Sun or Hi-C, BeatBox makes single-serving, sweet and fruity-flavored alcoholic beverages (in varieties like Blue Raspberry and Fruit Punch) in bright, eye-catching packaging.

The enduring popularity of hard sodas, seltzers, and ciders proves there was a market for a product line like BeatBox's, and the company was on the right side of that trend. Cuban agreed, investing $1 million for a third of BeatBox's shares, a hefty deal in terms of "Shark Tank" figures. "Not only did I give them $1 million when they came in, but I've put more money in after that, and they were crushing it," Cuban explained. "And then they've expanded into alcohol flavored seltzers. And now they're blowing up completely. They've done a good job of expanding the business." Clearly, Cuban has no remorse about jumping into the tank with these folks.

Yellow Leaf Hammocks woke up the Sharks

You might not think something as simple as a hammock would inspire high-stakes negotiations and million-dollar deals. After all, they're pretty common and are usually made from readily available materials. But Yellow Leaf's hammocks were clearly something special, different, and perhaps better than any other hammock that came before.

In 2020, Joe Demin and Rachel Connors, co-founders of Yellow Leaf Hammocks, used their time with the "Shark Tank" board of investors to ask for a cash infusion for their next-generation sleeping slings. Connors explained that he and his team had "conquered every obstacle" and devised a hammock that offered a closed-in feel made of soft-materials that didn't wiggle and wouldn't disintegrate under intense rain or sun.

Demin and Connors entered the tank asking for $400,000 in exchange for a 7 percent stake. But special guest shark Daniel Lubetsky, the head of Kind Snacks, had an even better offer: he put up $1 million and got a 25 percent stake in the fledgling hammock company.

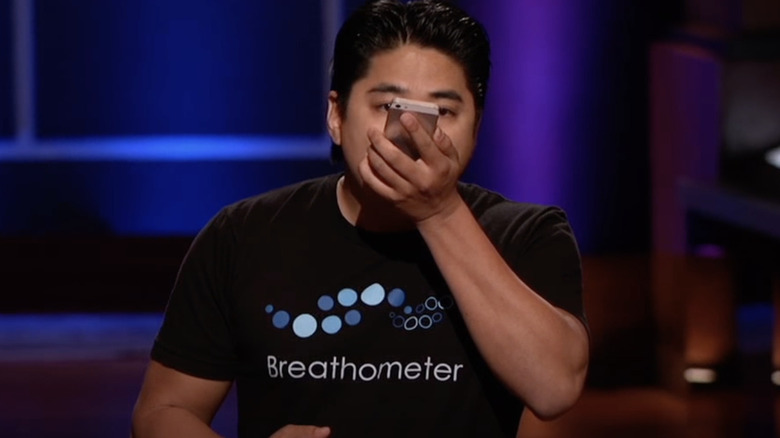

Breathometer took all five Sharks' breath away

Entrepreneur Charles Michael Yim went before the "Shark Tank" investor squad in 2013 to seek funding for his pet project, a product that he believed and suggested could, if used properly, save lives by reducing the number of intoxicated drivers on the road. His device: the Breathometer, a sleek, pocket-sized breath analyzer that plugged into a smartphone's headphone jack. After consuming alcoholic drinks, the user would breathe into it, and after a few seconds of analysis the machine would provide the user's blood alcohol level — and with it, a tacit recommendation of whether or not it was safe for them to drive home.

In an unusual arrangement — for "Shark Tank," at least — all five sharks present went in on a deal together. All told, Breathometer's founders walked home with $1 million that day in exchange for 15 percent of the company, with Mark Cuban leading the investment team by ponying up half of the financial injection.

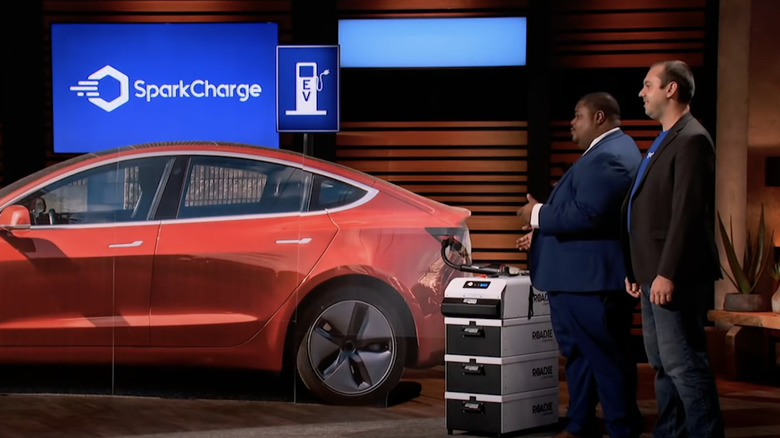

SparkCharge generated excitement and income

While there are lots of electric vehicle (EV) charging stations scattered across North America, they can be few and far between, putting a driver in a stressful situation if their car goes dead in the middle of nowhere. The solution, according to SparkCharge founder and CEO Josh Aviv: a portable, super-fast portable EV charging unit. "You sign up for a service, the different gas stations, everything, sign up to offer a service, so that people with EVs, like Teslas or whatever, if they're stuck somewhere on the side of the road, they need a quick charge to get somewhere, they'll come out and charge you up," "Shark Tank" investor Mark Cuban told Looper.

Aviv appeared on "Shark Tank" in 2020 in search of $1 million in additional funding (to add on to a $5 million nest egg) at the cost of a 6 percent stake. Cuban and fellow shark Lori Greiner were both so interested that they accepted Aviv's revised proposal: The duo could split the $1 million buy-in in exchange for a 10 percent stake along with 2 percent advisor equity each.

PolarPro focused on a million-dollar payday

In a 2015 episode of "Shark Tank," Jeff Overall touted PolarPro, the company he'd founded just four years earlier while he was a student and ski team member at the University of California, Santa Barbara. Dissatisfied with the ski run videos generated by GoPro cameras, the industry standard-bearer in POV vid-cap technology, he started making his own polarized lenses to improve the quality of his videos. From there, he started charging other athletes and photographers a reported $10 a pop for his creations. He did so well that he began professional manufacturing, grew his portfolio to more than two dozen products, and then sought out a major cash infusion from "Shark Tank."

A fight amongst the sharks broke out. Mark Cuban offered $500,000 for a 10 percent share, and Daymond John countered with the same figure for a higher stake and a willingness to take on licensing and distribution work if not a partnership with Cuban. Lori Greiner and Robert Herjavec also put deals on the table, but Overall ultimately teamed up with Cuban and Herjavec, landing half a million from both investors in exchange for a 10 percent stake to each.

GoumiKids' founders got big money for tiny clothes

There are plenty of baby clothes manufacturers out there competing for new parents' dollars, seeking to be the provider of swaddling clothes, sleeping garments, and activewear for the littlest of little ones. The brands that emerge are the ones whose clothes are attractive and as safe and non-toxic as possible. Those were the goals Lili Yeo and Linsey Eubuen, founders of Goumikids, had in mind when they created their company's initial product: baby mitts, extra soft and made from fabric derived from organically-grown bamboo. The idea is to put them on babies' hands when they're sleeping, so that they don't accidentally scratch themselves with their little fingernails. In 2020, Yeo and Eubuen represented Goumikids on "Shark Tank," touting their expanded and expanding product line of item, much like the mitts — stylish and durable and made from organic materials.

After arguing with the Sharks over their valuation — the investors thought Goumikids' assessment was far too high — they got down to business. Yeo and Eubuen wanted a massive $1 million in exchange for a substantial 8 percent stake in the company. Shark Kevin O'Leary bit, offering that $1 million in the form of a line of credit at 9 percent interest, and in return, he received a 10 percent stake in Goumikids.

Money from Shark Tank breathed new life into Boost Oxygen

On a very basic level, the human body only needs three things to survive: nutrient-rich food to eat, clean water to drink, and oxygen to breathe. Only the first two are widely available in the United States. While there's enough oxygen around to sustain life, it comprises just 21 percent of the air (per NASA). Plenty of people would certainly welcome more oxygen — a literal breath of fresh air to help the body recover after strenuous activity, to counter the effects of pollution, or even for an energy boost. Mike Grice and Rob Neuner, the chief proprietors of Boost Oxygen, hit "Shark Tank" in 2019 with its solution: oxygen in a can.

According to Neuner, supplemental, canister-style oxygen is readily available in Europe, but hard to find in the U.S. outside of medical environments. So, he gave the market a boost with Boost, selling canned oxygen in four sizes and multiple flavors, including one with a rosemary essence.

Boost Oxygen's duo came to "Shark Tank" seeking a hefty $1 million investment, for which they'd happily turn over a 5 percent stake in the company. Kevin O'Leary inhaled that pitch and exhaled a counter-offer: a $1 million loan with a 7.5 interest rate as well as 6.25 percent equity in Boost Oxygen. The deal was sealed.

xCraft flew into Shark Tank and flew out flush

Drones are a relatively new invention, and one with a number of applications, ranging from large-scale to small-scale. They can be used for everything from military and espionage missions to kids flying them around in the park or backyard for fun. In other words, drones are here to stay, and they're a growth industry. So when a small company on the cutting edge side of their robotic flying devices appeared on "Shark Tank," it managed to capture the attention, imagination, and funds of not one investing shark, but all five.

In 2015, Charles Manning and J.D. Claridge, founders of Idaho drone maker xCraft, entered the tank to show off their drone that can both hover and fly — and do so at elevations of up to 10,000 feet and speeds of up to 60 miles per hour. By the time of their "Shark Tank" debut, Manning and Claridge had sold nearly $200,000 worth of their drones in pre-orders by way of a Kickstarter campaign.

All five sharks present wanted in, so xCraft's team suggested a rare arrangement: all five "Shark Tank" panel members would contribute $300,000 each, in exchange for 5 percent equity. That amounted to $1.5 million, one of the biggest proposals ever negotiated on "Shark Tank," and certainly the biggest five-way deal.

LARQ's Shark Tank deal is nothing to sniff at

Everybody knows that drinking water is healthy, and countless individuals have bought or will buy a reusable bottle from amongst the almost endless array available. But all too often, that bottle — perhaps because it doesn't get properly washed enough, or because it's made from less-than-stellar materials — starts to stink. And nobody wants to keep up their healthy habit if it means drinking out of an impossibly smelly container.

Overcoming stinky bottles is what motivated Justin Wang to start a water container company called LARQ. In 2021, he sought out a hefty cash infusion from the investor panel on "Shark Tank." Immediately upon hitting the stage, Wang made his pitch, asking for $500,000 in exchange for 1 percent of his company, an offer so unbalanced and presumptuous that the Sharks become overcome with laughter before he's even finished his sentence. But Wang pushes through, explaining why bacteria growth leads to smells in water bottles, and how his team's containers are less likely to do so, as they're outfitted with a button that triggers an ultraviolet / LED light, which cleans the bottle in one minute.

The Sharks aren't laughing any more. Kevin O'Leary and Lori Greiner partner together for a rare "Shark Tank" team-up and successfully counter-pitch. They'd receive a 4 percent stake, more than Wang's 1 percent offer, but they also put up more capital: $1.5 million altogether.

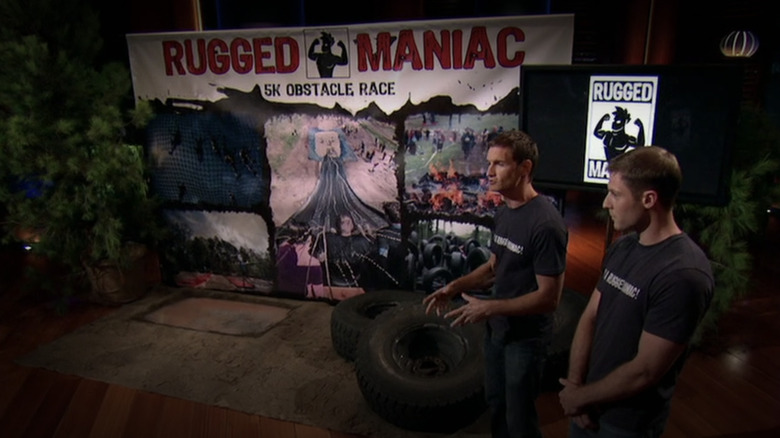

Rugged Maniac raced away with $1.75 million from Mark Cuban

Americans are always looking for something fun to do outside of the house. One can only go bowling, play miniature golf, or go to the movies so many times, and that explains how Rugged Races made itself into one of the fastest-growing interactive entertainment companies in the country. In 2014, Rugged Races founders Rob Dickens and Brad Scudder appeared on "Shark Tank" to explain and draw attention to its extreme obstacle courses. For a fee, customers could attend Rugged Maniac, a traveling event where they got to engage in more than 20 fun and very challenging feats of strength and agility, including leaping over fires, scaling walls, and negotiating mud pits.

"Shark Tank" investor Mark Cuban was quickly smitten, offering an almost unheard of sum of $1.75 million for a 25 percent stake in Rugged. "I think experiential entertainment is big. And so when I invested them in a few years ago, it was early in kind of the theme of people wanting to get out of the house and do as many things as possible," Cuban exclusively told Looper. "So the opportunity to become part of that was something I looked forward to and honestly worked out really well."

Indeed — according to the Boston Globe, New Media Investment Group purchased 80 percent of Rugged Maniac, and Cuban nearly doubled his original investment.

Ten Thirty One Productions generated a spooktacular sum

Attending the Haunted Hayride is a beloved, annual tradition for a vast many residents of the Los Angeles area. Conceived by Ten Thirty One Productions, tens of thousands of Halloween spook-seekers head to a dark, woodsy section of Griffith Park for a scary, open-air, frightful live theatrical experience. Led by founder Melissa Carbone, Ten Thirty One came to "Shark Tank" in search of additional funding and got it, with Mark Cuban investing $2 million in exchange for a 20 percent share.

Cuban actively helped grow the company. "They were killing it. And so we expanded to New York," Cuban explained to Looper. After expanding operations to eight U.S. cities, Cuban and the rest of Ten Thirty One's owners made a tidy profit when the company sold to Thirteenth Floor Entertainment. Still, the $2 million investment is one of largest ever seen on "Shark Tank."

"For a seven-figure deal, it's got to be a great business that I see the opportunity to really grow," Cuban said. "It's got to be something that I like the business myself. Because if I'm committing that much capital to it, I want to be able to enjoy it."

The creators of the Numilk milked Shark Tank for millions

Plant-based alternatives to popular, familiar, and long-entrenched foods derived from animals is a growing industry. Plenty of stores around the globe regularly stock milks that don't come from anywhere near a cow — creamy and tasty dairy-esque drinks made from soy, rice, almonds, hemp, cashews, and macadamia nuts. Public demand for "alt milks" is strong, and in 2021, the movement hit "Shark Tank."

Ari Tolwin and Joe Savino founded Numilk in 2018 to provide fresh, nondairy milk via sleek, high-tech kiosks. Numilk's flagship product: a push-button kiosk, where customers pay $2 for a reusable bottle and $3.99 for a fill-up of plant-based milk in almond or oat varieties and in three flavors: unsweetened, original, and chocolate. Tolwin and Savino enticed the sharks by volunteering that each kiosk costs about $30,000 to make and generates $50,000 in annual revenue, and that a line expansion was in the works, with a $699 fresh milk station for use in coffee shops and a $199 unit for home use.

Shark Tank panelist Mark Cuban was particularly impressed with the quality of the milk he made with an on-set Numilk kiosk. "You can tell it's fresh almonds," he said, adding that he figured the at-home device would eventually be a big seller. Tolwin and Savino asked "Shark Tank" for $1 million in exchange for 5 percent equity. Cuban upped the deal, offering $2 million for 10 percent equity.

Vengo's vending machines brought in millions

Clever advertising proved to be an extraordinarily attractive business proposition for the sharks when Vengo Labs founders Steven Bofill and Brian Shimmerlik appeared on "Shark Tank" in 2016, and their pitch became a major can't-miss opportunity for the show's investor panel.

A Vengo device, Shimmerlik and Bofill explained, is a wall-mounted vending machine that sells any number of items that it can also advertise with an embedded video screen. After raising $3.4 million in seed money to fund production of the Vengo units, Shimmerlik and Bofill headed into the tank to ask for a $2 million investment in exchange for a 12.5 percent equity share. The concept seemed so lucrative that the Vengo guys got what they wanted from a rare "Shark Tank" team-up: Kevin O'Leary and Lori Greiner put up the $2 million and split a three percent stake when all was said and done.

Kevin O'Leary said cheers to Zipz

No longer the exclusive purview of the wealthy and the elite, wine has grown more populist in the last few years, on par with other broadly popular alcoholic beverages like beer. According to Wine Spectator, Americans bought 328.9 million cases worth of fermented grape juice in 2020, and researchers estimate the industry will be worth nearly $700 billion by 2028. Mainstay "Shark Tank" investor Kevin O'Leary was likely aware of those upward-heading numbers in a December 2014 episode featuring Andrew McMurray, the Vice President of Zachys Wine and Liquor. McMurray needed a sizable investment from one or more of the Sharks to help his company change the way wine is sold and consumed. His product: Zipz, which is wine sold in individual serving sizes, packaged in plastic wine glasses.

The idea piqued the interest of some of the sharks. Mark Cuban didn't like the name "Zipz" and passed, and Robert Herjavec suggested that McMurray license the technology to other winemakers — but Kevin O'Leary was all-in. The shark agreed to invest $2.5 million in the Zipz project in exchange for a 10 percent stake. In terms of dollar amount negotiated on the show, that's the biggest deal in "Shark Tank" history.